History of Banking

What is Banking?

Banking refers to the business activity of accepting and safeguarding money owned by individuals and entities, as well as facilitating financial transactions. Banks play a significant role in the economy by providing various financial services such as loans, deposits, investments, and payment processing.

The history of banking can be traced back thousands of years when early civilizations engaged in rudimentary forms of economic activities. Over time, banking systems have evolved to become increasingly sophisticated and integral to the functioning of modern economies.

Origins of Banking

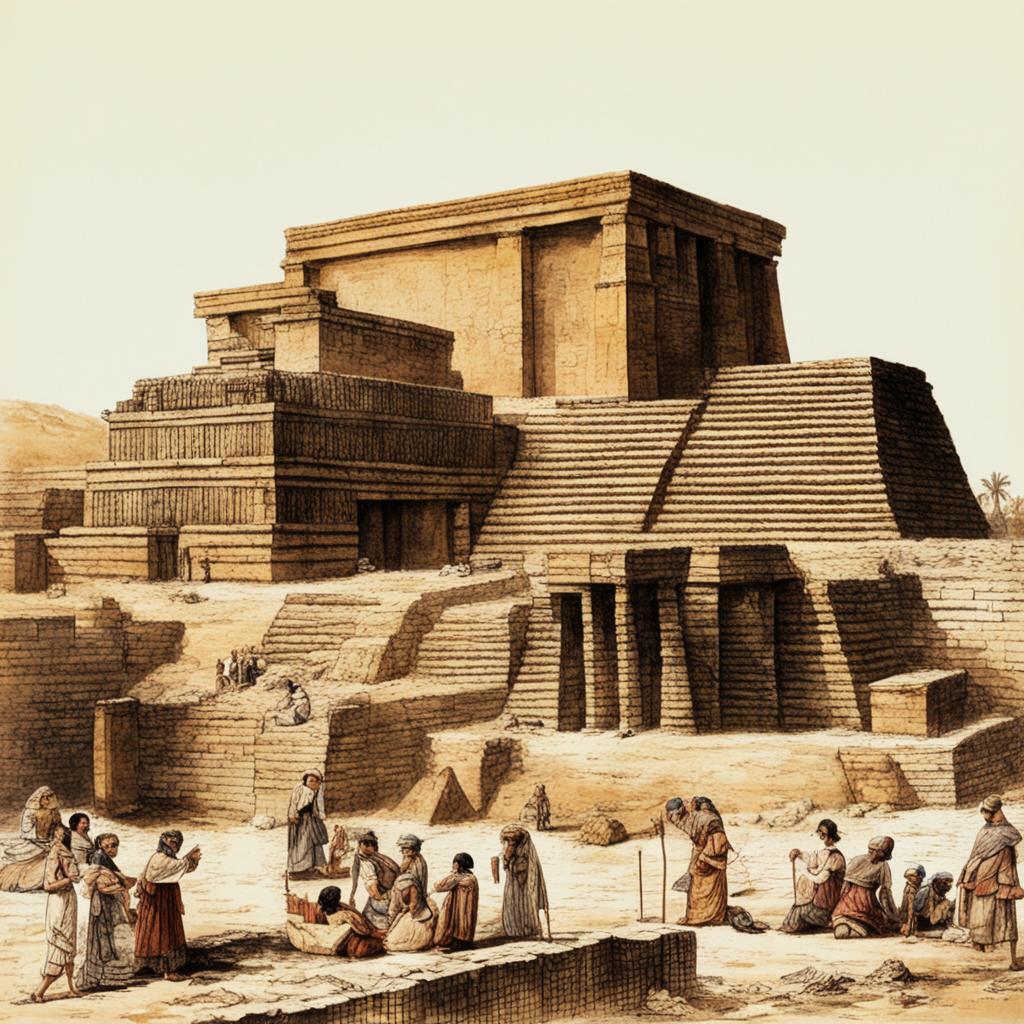

The origins of banking can be found in ancient Mesopotamia (modern-day Iraq) around 2000 BC. In these early times, temples acted as both religious centers and repositories for agricultural surplus. People would deposit their excess crops or valued possessions with the priests who would record these deposits on clay tablets.

As trade expanded during ancient times, merchants required a secure means to store their valuable assets while traveling long distances. This need gave rise to moneylenders who offered safe storage facilities for valuable items in exchange for payment or interest charges.

Early Banking Systems

Egypt also had an early form of banking called "hawala" during the Hellenistic period (between 332 BC - 30 BC). Hawala involved informal money transfer services where trust-based networks facilitated transfers without physical movement of money. Hawaladars (money brokers) played a vital role in this system by using their established relationships across different regions to allow transfers between parties.

In Ancient Greece and Rome, banker professionals emerged performing functions related to lending and managing financial affairs. The Roman Empire saw significant advancements in banking through institutions known as argentarii where individuals could deposit funds with bankers known as mensarii.

Evolution into Modern Banking

Medieval Europe: Emergence of Bankers & Moneylenders

During medieval Europe from the 11th century onwards, commercial activity revived, and merchants emerged as important figures in economic affairs. Moneylenders played a crucial role in financing trading ventures across Europe, often operating from the benches where they conducted their transactions (hence the term "bank" derived from the Italian word banca meaning bench).

Renaissance Banking

The Renaissance period (14th to 17th centuries) marked a significant transition in banking history. Prominent Italian families such as the Medici and Fugger became influential bankers through their successful financial enterprises. They provided loans to monarchs and financed large-scale projects such as trade expeditions.

Evolution of Modern Banking Institutions

With industrialization and the rise of capitalism during the 18th and 19th centuries, modern banking institutions began to take shape. Central banks were established to regulate monetary policy and stabilize economies. Commercial banks expanded their operations, offering more services beyond basic deposits.

The establishment of banks like Bank of England (1694), Bank of Sweden (1668), Bank of New York (1784), and others set precedents for banking systems around the world.

Technological Advancements

The development of new technologies dramatically transformed banking during the 20th century onwards. The introduction of telegraphy enabled faster communication across long distances, allowing for international transfers and real-time information exchange between banks.

In recent decades, computerization revolutionized banking further with ATMs, online banking platforms, electronic fund transfers (EFTs), debit/credit cards, mobile banking apps, and other digital innovations providing convenient access to financial services.

Conclusion

The history of banking is intertwined with human civilization's progress from early agricultural societies to our complex global economy today. From clay tablets to digital transactions within seconds, banking has undergone extraordinary transformations over thousands of years.

Understanding this historical backdrop provides valuable insights into why modern financial systems operate the way they do today – influenced by cultural practices, technological advancements, economic needs, political developments, and the pursuit of efficiency and convenience.

Questions to Learn More

Sponsored

Sponsored

Sponsored

Explore More:

Operational Risk

Operational risk is the potential for loss resulting from inadequate or failed internal...

Market Risk

Risk management in banking is a critical aspect of the banking industry. Managing...

Credit Risk

Risk management in banking is a critical aspect of the banking industry. Managing...

Risk Management in Banking

Risk management in banking is a critical aspect of the banking industry. Managing...

Glass-Steagall Act

The Glass-Steagall Act, also known as the Banking Act of 1933, was an...

Dodd-Frank Act

The Dodd-Frank Act, officially known as the Dodd-Frank Wall Street Reform and Consumer...

Basel Accords

Banking regulations refer to the laws, rules, and guidelines imposed by regulatory authorities...

Banking Regulations

Banking regulations refer to the laws, rules, and guidelines imposed by regulatory authorities...

Cash Flow Statement

The cash flow statement is an important financial statement for banks as it...

Income Statement

The income statement is an essential component of a bank's financial statements. It...

Balance Sheet

The balance sheet is one of the most important financial statements used by...

Bank Financial Statements

Bank financial statements provide a comprehensive overview of a bank's financial performance and...

Online and Mobile Banking

In today's rapidly evolving technology landscape, the banking industry has undergone a significant...

Credit Cards

Credit cards are one of the most prominent banking products offered by financial...

Understanding Different Types of Bank Loans: Features and Benefits for Personal and Business Financing

Loans are a core offering of banking institutions, providing individuals and businesses with...

Checking Accounts

A checking account is one of the most common banking products used by...